Corporation Tax

Rates

The rates for the three financial years from 1 April 2021 are as follows:

| Year beginning 1 April: | 2021 | 2022 | 2023 | 2024 | 2025 |

| Corporate Tax main rate | 19% | 19% | 25% | 25% | 25% |

| Corporate Tax small profits rate | N/A | N/A | 19% | 19% | 19% |

| Marginal relief lower profit limit | N/A | N/A | £50,000 | £50,000 | £50,000 |

| Marginal relief upper profit limit | N/A | N/A | £250,000 | £250,000 | £250,000 |

| Standard fraction | N/A | N/A | 3/200 | 3/200 | 3/200 |

| Main rate (all profits except ring fence profits) | 19% | 19% | N/A | N/A | N/A |

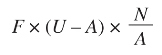

From 1 April 2023, the Corporation Tax main rate applies to profits over £250,000, and the small profits rate applies to profits of up to £50,000. Those thresholds are divided by the number of associated companies carrying on a trade or business for all or part of the accounting period. Companies with profits between £50,000 and £250,000 pay tax at the main rate reduced by a marginal relief determined by the standard fraction and this formula:

Where:

F = standard fraction

U = upper limit

A = amount of the augmented profits

N =amount of the taxable total profits

For companies with ring fence profits from oil or gas related activities, the main rate is 30%, and the small profits rate is 19%, with a ring fence fraction of 11/400, for all financial years from 2008.

Research and Development (R&D)

R&D merged scheme and enhanced intensive support (periods starting on or after 1 April 2024)

The merged scheme R&D expenditure credit (RDEC) and enhanced R&D intensive support (ERIS) replace the old RDEC and small and medium-sized enterprise (SME) schemes for accounting periods beginning on or after 1 April 2024. The expenditure rules for both are the same, but the calculation is different.

You can choose to claim under the merged scheme even if you are eligible for ERIS, but you cannot claim under both schemes for the same expenditure.

The merged scheme is a taxable expenditure credit and can be claimed by trading companies that are chargeable to Corporation Tax and have a project that meets the definition of R&D.

For expenditure under the merged scheme, the rate of R&D expenditure credit is 20%.

Enhanced intensive support (ERIS) allows loss-making R&D intensive SMEs to deduct an extra 86% of their qualifying costs in calculating their adjusted trading loss, as well as the 100% deduction which already appears in the accounts (or in the computations) to make a total of 186% deduction as well as claim a payable tax credit, which is not liable to tax and is worth up to 14.5% of the surrenderable loss.

SME scheme (periods starting before 1 April 2024)

Small and medium (SME) companies can claim enhanced deductions for expenditure on R&D projects at 186% (230% before April 2023) of qualifying expenditure. Where the deduction is claimed and the company makes a loss, it can claim a cash credit from HMRC of 10% of that loss from 1 April 2023, previously 14.5%. Where the SME spends at least 40% of their total expenditure on qualifying R&D from 1 April 2023, it can claim the higher payable tax credit of 14.5%.

Each R&D project must be carried on in a field of science or technology and be undertaken with an aim of extending knowledge in a field of science or technology.

Research and Development Expenditure Credit (RDEC) scheme (periods starting before 1 April 2024)

Large companies can claim an extra 20% deduction from 1 April 2023 on the following qualifying expenditure:

- Staffing costs

- Expenditure on externally provided workers

- Software and materials consumed or transformed

- Utilities but not rent

- Payments to clinical volunteers

- Subcontractors of qualifying bodies and individuals/partnerships

For staff working directly on the R&D project, you can claim for the following costs, as long as they relate to R&D:

- Bonuses

- Salaries

- Wages

- Pension fund contributions

- Secondary Class 1 National Insurance contributions paid by the company

RDEC differs from the previous R&D scheme for large companies as it is an 'above the line' tax credit and can be accounted for in the profit/loss statement.

For more information see our ...

What our clients say about us...

"Paul has provided accountancy services to my company for 2 years now. I can recommend Paul very highly; his skills as an accountant are highly detailed and professional and he is always available to provide advice. One aspect of the way Paul works that I greatly appreciate is a preference to meet face to face when there is a detailed conversation to be had. I personally find this more productive and is a benefit of working with a small accountancy firm that you wouldn't get with the large faceless providers."

ALISTAIR FAIRWEATHER - PROGRAMME & PROJECT MANAGER, DELIVERING/RESCUING I.T. 7 BUSINESS CHANGE WITH BUDGETS UPTO £50M INC SUPPIER MANAGEMENT

"I couldn't ask for more from Paul as an Accountant. Paul has been accountant to Work Relief Charity Recruitment for just over a year now and is proving an invaluable asset. Accurate, knowledgeable, flexible with an emphasis on service delivery, I would recommend Paul's services to any organisation looking for an accounts professional."

Neil Price - Managing Director at Work Relief Charity Recruitment

"Paul was a referral from a family member when I started my business 2 years ago. As this was the first time I had ever run my own company I was totally clueless over the financial side of matters and was worried that I may have made mistakes in any of my accounting. I needn't have worried as after enaging Paul for a set monthly fee he was always there on the end of the phone for all sorts of questions I had and no matter how trivial they were Paul gave me all the information I required and more and did an excellent and painless job at the end of my first year! Couldn't ask for any better to be honest. Just two words - hire him!!!"

Lee Westrap MBCS - Director - Bulldog IT Services

Cookies are small text files that are stored on your computer when you visit a website. They are mainly used as a way of improving the website functionalities or to provide more advanced statistical data.

Cookies are small text files that are stored on your computer when you visit a website. They are mainly used as a way of improving the website functionalities or to provide more advanced statistical data.